Gross annual income calculator

It can be any hourly weekly or annual before tax. This is the income tax you will have to pay as a percentage of your gross income.

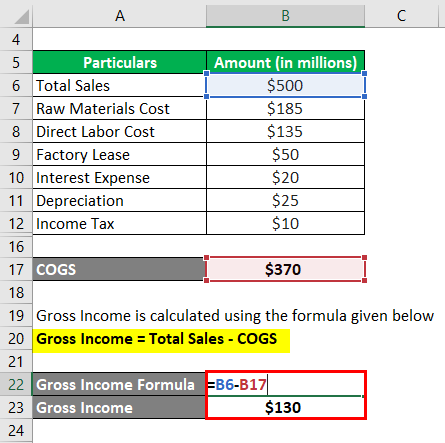

Salary Formula Calculate Salary Calculator Excel Template

How to Calculate Annual Income.

. The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual. This places Ireland on the 8th place in the International. Well use the monthly gross salary from our previous example and multiply it by 12.

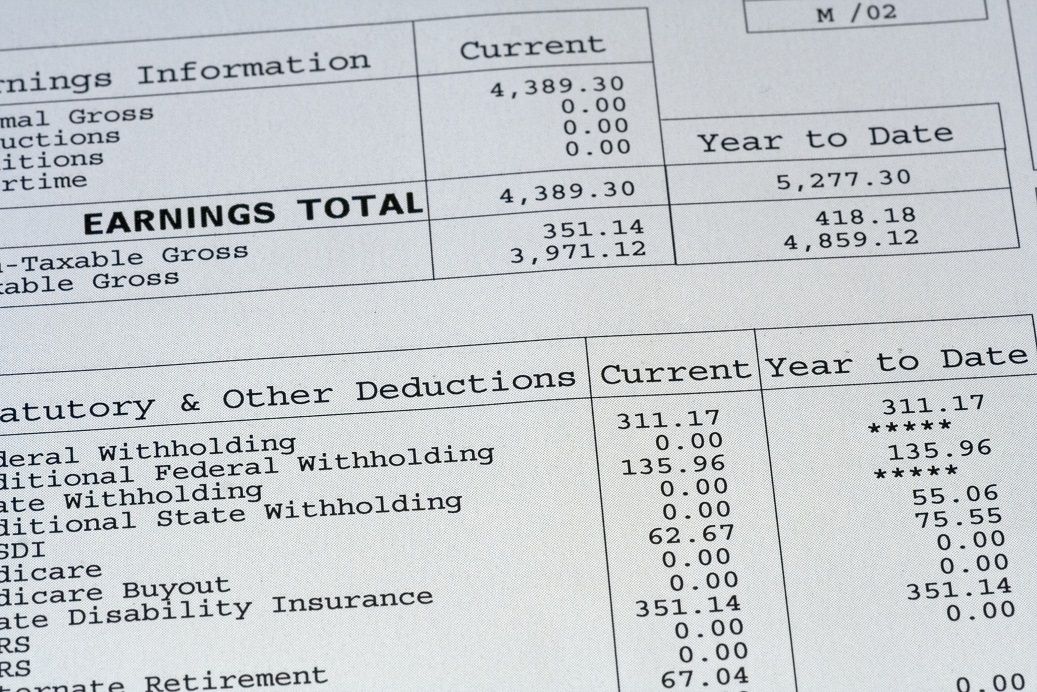

Net income 1 - deduction rate For example if your net income was. AGI gross income adjustments to income. Effective Income Tax Rate.

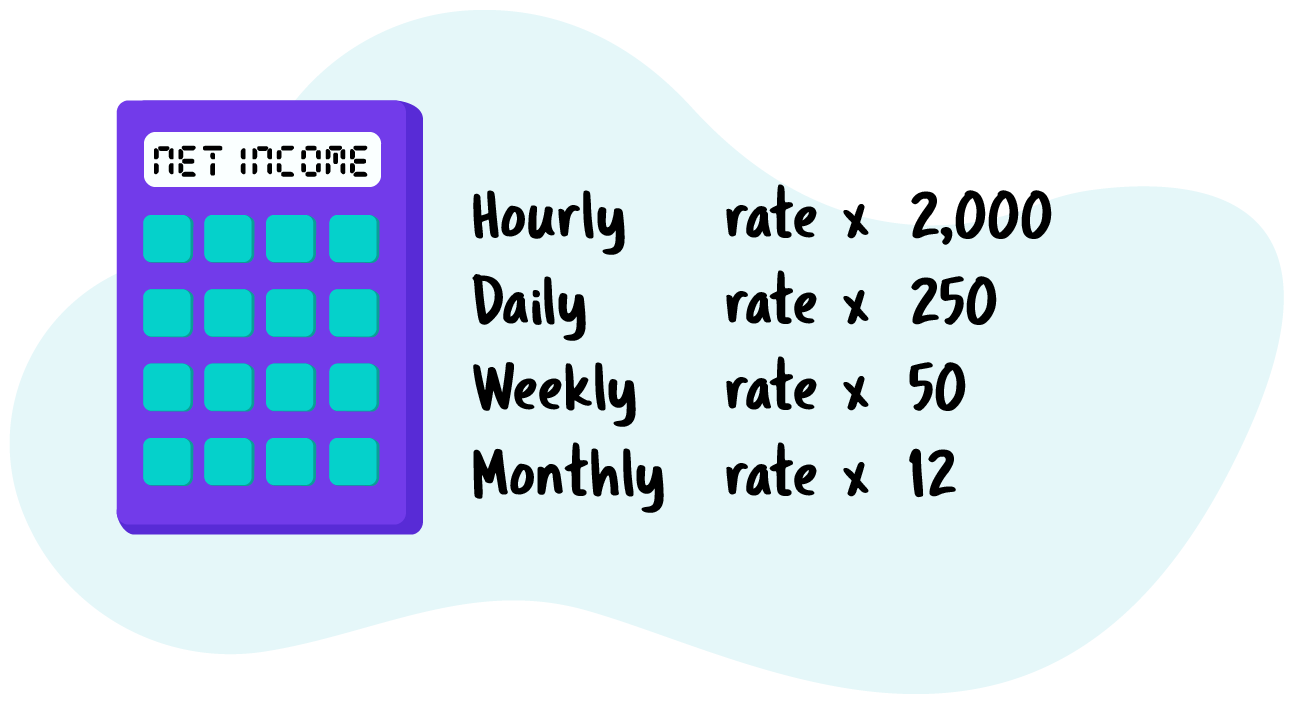

The calculator calculates gross annual income by using the first four fields. Gross Annual Income of hours worked per week x. To convert from your net annual income to your gross annual income you can use this simple formula.

Before the net annual income can be estimated calculating the gross annual income is the necessary first step. Compute your annual gross salary first. In our example your annual salary would be 3545520 680 per week times 5214 weeks per year.

You can calculate your AGI for the year using the following formula. The PAYE Calculator will auto calculate your saved Main gross salary. Gross income the sum of all the money you earn in a year.

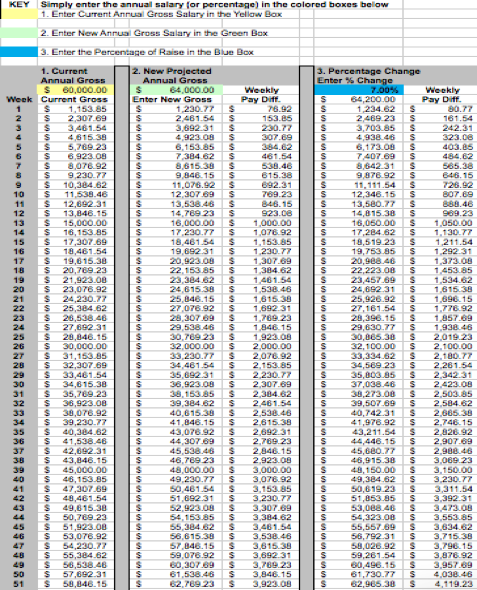

This yearly salary calculator will calculate your. Multiply that amount by 52 the number of weeks in a year the number of weeks in a year. The top rate of 684 is about in line with the US.

Multiply your weekly salary Step 2 by the number of weeks you work per year. All other pay frequency inputs are assumed to be holidays and vacation. How to Use the Annual Income Calculator.

25000 x 12. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income.

You can calculate your take home pay based on your gross income PAYE NI and tax for 202223. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. Simply enter your annual salary and click calculate or switch to the advanced tax calculator to.

You can change the calculation by saving a new Main income. Heres the breakdown. Nebraska has a progressive income tax system with four brackets that vary based on income level and filing status.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. If you are paid hourly multiply your hourly. From the perspective of an individual worker.

Enter the gross hourly earnings into the first field. To use this annual income. Multiply the amount of hours you work each week by your hourly salary.

3 Ways To Calculate Your Hourly Rate Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Income Calculator Online 53 Off Www Ingeniovirtual Com

Yearly Income Calculator Online 55 Off Www Ingeniovirtual Com

Gross Pay Definition Components And How To Calculate

4 Ways To Calculate Annual Salary Wikihow

Monthly Interest Income Calculator Kurortstroy Org

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Formula Calculator Examples With Excel Template

Annual Income Calculator Flash Sales 52 Off Www Ipecal Edu Mx

Annual Income Definition Calculation And Quiz Business Terms

Yearly Income Calculator Online 55 Off Www Ingeniovirtual Com

Annual Income Calculator

Gross Income Formula Step By Step Calculations

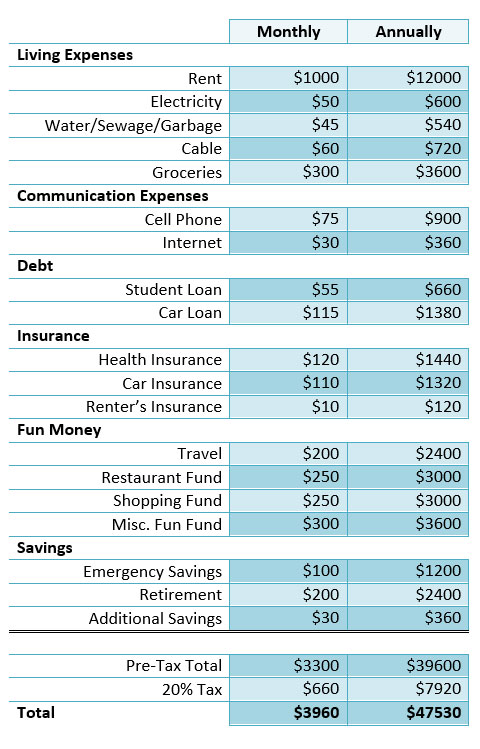

How To Calculate How Much You Need To Earn

Calculate Income Tax In Excel How To Calculate Income Tax In Excel